Rare earth NdFeb market analysis

2023-02-28 09:57Ndfeb is a new type of magnetic material. Its appearance solves some defects of traditional magnetic materials. It has high permeability, high magnetic energy product, high hysteresis and other excellent characteristics. Compared with other permanent magnet materials, ndfeb permanent magnet material has higher permeability and greater magnetic energy product, so it has a wide range of applications in electronic, electrical, mechanical and other fields.

Ndfeb permanent magnet material has excellent magnetic properties, such as high permeability, high magnetic moment and high magnetic return. These characteristics make the Ndfeb permanent magnet material in the electric motor, electric vehicle, household appliances and other fields have a wide range of application prospects. For example, in the motor, ndfeb permanent magnet material can improve the efficiency of the motor, prolong the life of the motor; In electric vehicles, ndfeb permanent magnet material can improve the endurance capacity of electric vehicles and reduce the volume and weight of electric vehicles; In household appliances, Ndfeb permanent magnet material can improve the energy efficiency of electrical appliances.

In the electronic field, NdFeb permanent magnet material is mainly used in the manufacture of motors, sensors and so on. Because of its high permeability and high magnetic energy product, the power of the motor is improved, and can save energy. In addition, NdFeb permanent magnet material can also be used as the core component of the sensor to improve the sensitivity and stability of the sensor.

In the electrical field, Ndfeb permanent magnet material is often used to make magnets, magnetic yoke and so on. Because of its high permeability, it can improve the magnetic force of the magnet, so that the magnet can produce a higher magnetic force in a shorter time, so as to improve the efficiency of the motor. In addition, Ndfeb permanent magnet material can also be used as the core component of magnetic yoke to improve the permeability and stability of the yoke.

The NdFeb crisis

1. Volatility in rare earth prices

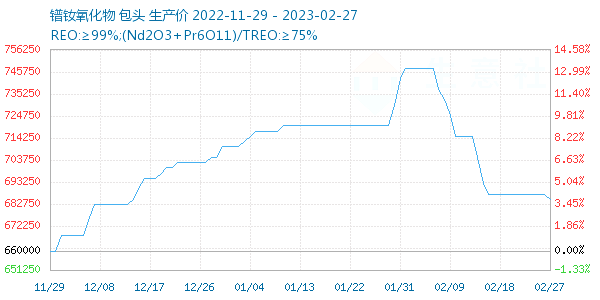

Rare earth prices have fallen recently, but are still generally higher than in previous years. Ndfeb enterprises are differentiated, large enterprises are affected by limited, but small and medium-sized by the price of raw materials. Affected by the rare earth price, the production of Ndfeb is difficult to survive and the industrial chain is restricted. Last year, the US launched Section 232 investigations to localize production of its industrial chain and reduce its dependence on imports of NdFeb from China. Our country still has the advantage in the short term, but the United States has frequent aggression, and the long-term danger cannot be overlooked.

Rare earth prices fell, about 830-850,000 yuan/ton of praseodymium neodymium oxide, down about 5%; The prices of neodymium oxide and praseodymium oxide were 873-893,000 yuan/ton and 86.0-880 yuan/ton, respectively, both decreased to varying degrees. Rare earth prices see limited long-term decline, as the domestic economy recovers, demand increases, will remain at a high level. The biggest upward pressure on rare earth prices comes from small and medium-sized producers, who cannot produce because of lack of funds and their customers cannot accept the high cost. Long-term irrational development will cause price fluctuations, not conducive to the development of the industry, but also have an impact on investors. The profits of small and medium-sized producers may fall to a loss due to price fluctuations.

Unlike small and medium-sized enterprises, which are plagued by rare earth costs, large permanent magnet materials companies generally have strategic cooperation with upstream companies and can obtain raw materials at below market prices. In addition, big companies can transfer the price of rare earths downstream. "On the one hand, the company produces customized products that require customers to sign contracts at real-time market prices. On the other hand, some customers sign long-term agreements with the company that include price adjustments, such as the ability to adjust sales prices to market prices every quarter. But the price transmission is not unimpeded, large permanent magnet material enterprises are also facing the trouble of lock price. The downstream lock price result is that manufacturers cannot transfer the cost by raising prices and must absorb the rising cost pressure by themselves.

2. The rise of raw materials leads to technology substitution by end customers.

Ndfeb is widely used in new energy vehicles, frequency conversion air conditioning, wind power generation, industrial automation, 3C intelligent consumer electronics and other fields.

It is reported that in the face of the high price of rare earth prasedymium neodymium, some motor manufacturers through modifying product design, reduce the use of the motor on NdFeb magnetic steel. Middle and low grade began to use ferrite to replace, high grade to use now relatively cheap samarium cobalt magnetic steel for the record. For the top enterprises, the most afraid of systematic risk is technology replacement. The weakness of large enterprises is that the ship is difficult to turn around. After hundreds of millions of equipment and technology are put into a product, once the downstream customers change the design and no longer use the product, it will cause a huge blow to the NdFeb industry. A precedent for downstream technology substitution was set in 2011, when a surge in rare earth prices led some companies to revert to low-end ferrite, leading to a slump in the industry for three to four years.

In addition, in the field of 3C loudspeaker, the emergence of new MEMS technology adopts the single-chip semiconductor process to integrate the loudspeaker (actuator and diaphragm) on the silicon wafer, which can sound without the use of magnetic steel, aiming to replace the traditional moving coil and moving iron voice coil. For now NdFeb manufacturers the most terrible is so, not the replacement of peer price, but the cross-field replacement brought by technological innovation. It is reported that the loudspeaker in the NdFeb industry chain accounts for 10-15%, but for small and medium-sized enterprises can reach 30-40%, because small and medium-sized enterprises can not get large motor projects. The mass production of the new MEMS is expected to begin in the third quarter of 2023, and 2024 will be a major crisis for small and medium-sized companies that rely on the loudspeaker industry.

Article source Changjiang Nonferrous metal network