Poor demand, rare earth market fell sharply in the first half of this year

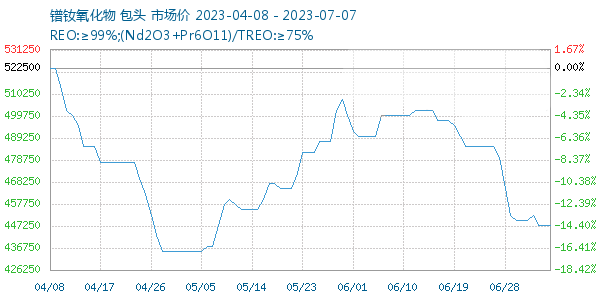

2023-07-07 15:25In the first half of 2023, the price trend of the domestic light rare earth market fell sharply. The price of neodymium oxide market at the beginning of the year was 770,000 yuan/ton, and the market price in the middle of the year was 477,500 yuan/ton, with a half-year price drop of 37.99%; the price of metal neodymium at the beginning of the year was 952,500 yuan Yuan/ton, the mid-year market price is 602,500 yuan/ton, a half-year drop of 36.75%; the price of praseodymium and neodymium oxide at the beginning of the year is 710,000 yuan/ton, and the mid-year market price is 450,000 yuan/ton, a half-year drop of 36.62% The price of praseodymium and neodymium alloy at the beginning of the year was 865,000 yuan/ton, and the market price in the middle of the year was 560,000 yuan/ton, with a half-year drop of 35.26%; tons, with a half-year drop of 31.29%; the price of metal praseodymium at the beginning of the year was 915,000 yuan/ton, and the mid-year market price was 627,500 yuan/ton, with a half-year drop of 31.42%. The trends of each product are as follows:

In the first half of 2023, the price trend of the heavy rare earth market will decline. According to statistics, the domestic market price of dysprosium oxide at the beginning of the year is 2.5 million yuan/ton, and the price in the middle of the year is 2.225 million yuan/ton, with a half-year decline of 11%; the price of dysprosium metal at the beginning of the year is 3.21 million yuan / ton, the mid-year price was 2.71 million yuan/ton, with a half-year drop of 15.58%; the price of dysprosium-iron alloy was 2.485 million yuan/ton at the beginning of the year, and the market price at the end of the year was 2.095 million yuan/ton, with a half-year drop of 15.69%.

It can be seen from the rare earth trend chart that the light rare earth market in the domestic rare earth market has experienced a relatively large decline, while the heavy rare earth market has experienced a relatively small decline.

From the beginning of the year to the end of April, due to the lack of inquiries from downstream metal and magnetic material enterprises, most of the downstream manufacturers mainly consumed existing stocks, the center of gravity of the actual transaction price of rare earths continued to move downwards, the prices of rare earth metals and oxides fell at the same time, and the raw material costs of metal factories The inversion situation is still difficult to alleviate in the short term, and some metal factories have reduced production. Coupled with the weak demand from downstream users, the continuous release of production capacity of rare earth manufacturers, and the bearish view of some traders on the market, the market confidence remains sluggish and the wait-and-see sentiment of rare earth practitioners has further intensified under the circumstance that the consumption capacity of downstream purchasers continues to be insufficient. In the end, the import of rare earth raw materials increased significantly. At the same time, the market turnover was relatively low, and the operating rate of the separation plant hit a new low. Multiple negative factors superimposed, and the price of rare earths accelerated.

Entering May, auto promotions have achieved remarkable results, and inquiries have increased. Since the price of light rare earths has been falling for a long time in the early stage, the quotations of the holders are relatively firm, and the actual transaction prices have risen accordingly. Recently, market inquiries and quotations are relatively active. As the inventory is exhausted, the transaction volume has increased, but the growth of downstream demand is slow, market information is still weak, the increase in orders from metal factories is not large, and the wait-and-see sentiment in the rare earth market still exists. Difficult to follow up for a long time.

In June, the domestic rare earth market returned to a downward trend. Inquiries in the NdPr product market were relatively quiet, and transactions were mainly based on rigid demand. Some companies’ efforts to raise prices declined. Coupled with insufficient demand support, the domestic rare earth market declined. In June, the price of metal praseodymium and neodymium was still upside down, mainly to ensure the supply of long-term cooperation orders, middlemen cautiously replenished goods in small quantities, and transactions were limited. Both rare earth production and market inventory have declined recently, the supply of raw materials is tight, the market spot is small, sellers are cautious in quoting prices, and the transaction situation is weak.

Supply side: In 2023, the first batch of rare earth mining, smelting and separation total control indicators issued by the Ministry of Industry and Information Technology and the Ministry of Natural Resources are 120,000 tons and 115,000 tons respectively. Among them, the total index of light rare earth mining is 109,057 tons, an increase of 22.1% compared with the first batch in 2022; the total index of medium and heavy rare earth mining is 10,943 tons, a decrease of 4.7% compared with the first batch of 2022. The index kept increasing, and the heavy rare earth index was slightly lowered, so the light rare earth market fell even more in the first half of the year. After years of governance, the domestic rare earth industry has gradually formed a supply pattern with large groups as the main body and relatively concentrated raw materials. With the continuous development of foreign rare earth industries, China's rare earth production share has dropped from 90% to 70%. The development of foreign rare earth industries is not good for domestic rare earth market prices.

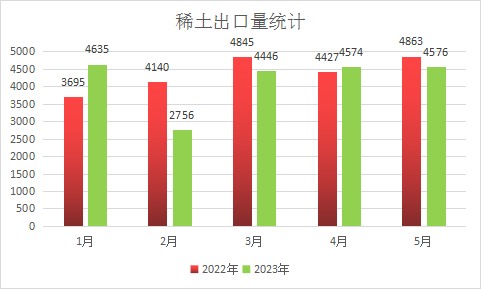

Import and export: From January to May 2023, China's cumulative total import of rare earths was 73,033 tons, a year-on-year increase of 31.9%; from January to May 2023, China's cumulative total export of rare earths was 20,987 tons, a year-on-year decrease of 4.4%. There has been a decrease, and the demand for rare earths has decreased. The import and export statistics of rare earth products from January to May 2023 are as follows:

On the demand side: The continuous development of the new energy industry has brought certain support to the domestic rare earth industry. Due to the launch of car purchase promotions and marketing activities in many places, the production and sales of new energy vehicles have increased. In May, the production and sales of new energy vehicles completed 713,000 units and 717,000 vehicles, a year-on-year increase of 53% and 60.2% respectively, with a market share of 30.1%. From January to May, the production and sales of new energy vehicles reached 3.005 million units and 2.94 million units respectively, a year-on-year increase of 45.1% and 46.8% respectively, with a market share of 27.7%. Recently, the state has accelerated the construction of charging infrastructure to better support new energy vehicles going to the countryside, which will help release the potential of rural consumption and increase the sales of new energy vehicles. Although the automobile market has grown, the rare earth market is still under great pressure, and the contradiction between supply and demand is relatively serious In the first half of the year, the price trend of the rare earth market declined.

Market outlook forecast: Although rare earth downstream industries such as automobiles and wind power have developed well in the first half of the year, it is difficult to boost confidence in the rare earth market. The main reason is that magnetic material companies mainly consume raw material stocks and purchases are small. host. The recent global economic situation is not optimistic. China’s exports have been restricted to a certain extent. In addition to the continuous development of foreign rare earth industries, the downward pressure on rare earth prices in the short term is still great. There will be some growth in production and sales, coupled with the continuous rapid development of new energy, new materials, energy-saving and environmental protection industries, there is still a gap in domestic demand for rare earths, and the development prospects of the rare earth industry are still broad. The rare earth market may usher in an upward trend in the fourth quarter.